Like it or not, many of us are laden with debts, usually from large purchases like homes and cars. While most of us have carefully evaluated our means of paying off our debts, many of us cannot be so sure if anything happens to us. Will our family be able to cope with the debt that lands on them after we are gone? Should you consider some form of safety net for our loved ones in the unfortunate event we are taken away unexpectedly?

Decreasing Term Insurance

One very affordable option that you have is to consider a Mortgage Decreasing Term Insurance. If you want to find out the differences between the main life insurances, you can refer to my previous post on the 3 main types of life insurance. A Mortgage Decreasing Term Insurance basically offers coverage for a duration in decreasing values, which is designed to match the amount of your debt or liabilities. In the beginning, your debts will be the largest and it should decrease as time goes by. Thus coverage required will also decrease accordingly. This will ensure that in the event that the sole breadwinner of the family suffers an untimely death, coverage from the Mortgage Decreasing Term Insurance will be adequate to pay off the debts left behind.

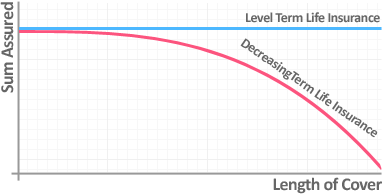

An example of how a Mortgage Decreasing Term Insurance might structure their payout can be seen below in comparison with the Level Term Life Insurance, which offers consistent coverage through its term. Different insurers will offer different decreasing curves.

There is another variation of this policy, which is the Joint-Life Mortgage Decreasing Term Insurance (first-to-die basis). This policy caters to married couples who are jointly servicing a loan and offers payout in the event of a death of either the husband or the wife.

Decreasing Term Insurance Rider

A second viable choice is to purchase a decreasing Term Insurance as a rider upon an existing permanent policy (non-Term policy). This is of course assuming that you already have or are planning to purchase a Whole Life or Endownment policy. It gives you the coverage of a decreasing Term Insurance while paying less than a separate Term Insurance alone.

There will obviously be other possibilities, but these are the 2 most obvious ones that you should be aware of. To evaluate your exact needs and to recommend the best options, please feel free to give me a call or drop me a message for a free consultation.

Recent Comments