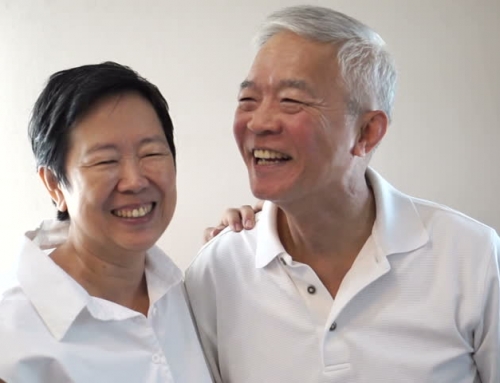

The Singapore pension scheme is pretty complex and especially if you are slightly older, there are more options for you to choose from. One of the main questions I get is which scheme is more appropriate?

At this point, there are 2 different schemes that one can potentially choose from depending on your age, namely:

1) Retirement Sum Scheme (RSS)

For Singaporeans or PR born before 1958, by default, you will be on the RSS scheme, assuming they meet the minimum sums required in their Retirement Accounts (RA). There are 2 different minimum sums set: 1) Basic Retirement Sum (BRS) applies for those who own a property with remaining lease till at least 95 years old. 2) Full Retirement Sum (FRS) applies for those who do not qualify for BRS. These minimum sums increase with time depending on when you hit 55. When you reach 55 years old, your Special and/or Ordinary Accounts savings will be transferred to your Retirement Account (RA), up to the Full Retirement Sum (FRS). However, you have a choice to switch to the CPF Life scheme if desired.

You can choose to set aside a larger retirement sum, up to the Enhanced Retirement Sum, by topping up your RA using cash or transferring your remaining CPF savings in the Special and/or Ordinary Accounts via the Retirement Sum Topping-Up Scheme (RSTU).

The estimated payouts based on how much one has in the Retirement Account are as follows:

| Monthly Payouts from 65 | RA savings needed (if age 55 in 2021) | RA savings needed (if age 55 in 2022) |

|---|---|---|

| $770 - $830 | $93,000 | $96,000 |

| $1,430 - $1,530 | $186,000 | $192,000 |

| $2,080 - $2,230 | $279,000 | $288,000 |

Payouts will continue until the RA is depleted.

2) CPF Life

For Singaporeans or PR born after 1958, they will be automatically be placed in the CPF Life scheme. The CPF Life scheme is similar to buying a lifetime annuity plan using your RA.

The estimated payouts based on how much one has in the Retirement Account at 65 are as follows:

| Mthly Payout from 65 | CPF Life premium at 65 | RA amount needed at 60 |

|---|---|---|

| $350 - $370 | $60,000 | $45,800 |

| $960 - $1,030 | $184,400 | $147,600 |

| $2,080 - $2,230 | $415,300 | $337,300 |

Main differences between RSS and CPF Life

1. RSS payouts will be deducted from your RA account and will last as long as you have sufficient funds in your RA. CPF Life payouts will last for life depending on which tier you qualified for.

2. RSS payouts are fixed depending on how much you have in RA. CPF Life payouts are also determined based on how much you have in your RA, but payouts are not guaranteed and subject to market conditions.

3. As payout criterias are different for each scheme, the amount one needs to set aside in the RA also differs.

In conclusion, there are pros and cons for either schemes and whether you choose to stay on in the RSS or to switch to CPF Life will depend on what you want from your retirement and also what you have in your RA. Naturally, if having the certainty of a lifetime stream of income is important to you, albeit non-guaranteed amounts, then CPF Life is the obvious way to go.

Recent Comments