If you are around 40s or getting to 40, you should have heard about the recent announced changes to the National Healthcare scheme Eldershield. The government will be enhancing the Eldershield scheme into Careshield. So what does that mean for you?

What are my options?

If you are born in 1980 or later, you will be enrolled in Careshield Life and it is mandatory. So you really do not have any options, just like for Medishield. Sorry about that.

If you are born before 1980, you have a few options:

-

1. Automatic enrollment into Careshield Life in 2021, which means you will be switched out from your current Eldershield scheme into Careshield Life.

2. Opt-out of Careshield Life but stay in existing Eldershield scheme.

3. Opt-out from Careshield Life and Eldershield before 23 Dec 2023 and get refunded.

Features

So what exactly are the main differences between Eldershield Life and the new Careshield Life?

1. Payout Duration

The largest change between Eldershield 400 and Careshield is the guaranteed payout duration. For Eldershield, payout duration is set at a limit of 6 years. But under Careshield, payouts will continue for life as long as the severe disability conditions persist.

2. Payout

Payouts will also increase from $400/mth with the basic Eldershield 400 to $600/mth and above depending on when claims are made. From 2020, payouts will start at $600/mth and the fixed payouts will increase every year subsequently. For example, if claim is made in 2025, estimated eligible payout will be about $662/mth and fixed at that amount for as long as the severe disability persists. This is to keep pace with inflation of costs depending on when the claim is made.

3. Premiums

With increased benefit of payouts and duration, it is not surprising that premiums will also be increased and starting at age 30.

4. Premium duration

For Singapore Residents born 1980 or later, premiums are paid from the age of enrolment until age 67. Premiums will increase over time, to support payout increases. For the first five years of CareShield Life implementation, payouts and premiums will both increase by 2% per year.

For Singapore Residents born 1979 or earlier

Singapore Residents born 1979 or earlier who join CareShield Life will pay a base premium. The base premium is generally paid from the age of enrolment until age 67, but Singapore residents who join at age 59 or older will be able to spread their base premiums over 10 years, beyond age 67.

| Eldershield 400 | Careshield | |

|---|---|---|

| Payout duration | 6 years | Lifetime |

| Payout | Fixed $400/mth | $600/mth in 2020 and increased every year after 2020. But fixed at point of claim. |

| Premiums | ~$175/yr (40yr male) ~$218/yr (40yr female) | ~$206/yr (30yr male) ~$253/yr (30yr female) |

| Premium duration | Payable till age 65 or lifetime | Payable till age 67 |

Subsidies

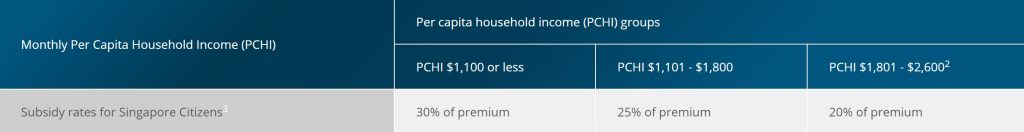

The Government will provide means-tested premium subsidies of up to 30% to improve the affordability of your CareShield Life premiums. Additional transitional subsidies or participation incentives will also help to offset your annual premiums for a limited period. For those who cannot afford CareShield Life premiums even after premium subsidies, use of MediSave and family support, you may be eligible for Additional Premium Support.

No one will lose their CareShield Life coverage due to financial difficulties.

Conclusion

In my view, there are still uncertainties with regards to the full implementation and details of Careshield. It will not come into effect until 2020. And until then, what should one do? If you are eligible for Eldershield already, then you should still get the Eldershield upgrade if you feel that it meets your needs. Once Careshield kicks in, you can then consider your options, taking into account the full details of Careshield at that point. If you are not eligible for Eldershield yet, then no point thinking about it now as there is nothing you can do anyway. Finally, if you are already on Eldershield and have upgraded, then sit tight and wait till 2020 before seeing if anything needs to be done.

Recent Comments